- Insight

Media

Why More Malaysians Are Turning to Digital Financial Consultants

The way Malaysians manage their finances is changing. With the rise of digital technologies, more people are seeking financial advice online, turning to digital financial consultants for guidance. This shift, which gained momentum during the pandemic, is reshaping how individuals and businesses approach their financial decisions. But what’s driving this change, and why are digital financial consultants becoming the preferred choice for so many? Let’s explore.

The Shift Towards Digital Financial Services in Malaysia

The pandemic forced many industries to rethink how they operate, and financial consulting was no exception. With face-to-face meetings becoming less feasible, digital platforms stepped in to bridge the gap. What began as a temporary solution has now become the new standard for accessing financial advice.

This shift has transformed how Malaysians approach their finances, with digital platforms offering a level of convenience and flexibility that traditional methods often lack. By adapting to these changes, the financial consulting industry has not only maintained its relevance but also opened the door to new opportunities for innovation and inclusivity.

Whether it’s planning to refinance, managing financial goals, or exploring loan options, digital platforms are reshaping the financial landscape, making it easier for Malaysians to take control of their financial futures.

Why Malaysians Are Choosing Digital Financial Consultants

What makes digital financial consultants increasingly attractive to Malaysians? Here are some of the key reasons:

Flexibility and Convenience

Unlike traditional consulting, which often requires scheduling face-to-face meetings, digital platforms allow users to access advice anytime, anywhere. This is particularly beneficial for busy professionals, parents, or those living in rural areas who may not have easy access to financial institutions. This shift has broken down barriers like geographical distance and time constraints, making financial advice more inclusive.

Affordability

Cost is another significant factor driving this shift. Traditional consulting services often come with higher fees due to overhead costs like office space and in-person meetings. Digital platforms, on the other hand, are more cost-effective, allowing financial advice to reach a wider audience who might have previously found such services out of their budget.

Personalised and Tailored Advice

Digital financial platforms are leveraging advanced technologies like artificial intelligence (AI) and machine learning to provide personalised advice. These tools analyse user data, such as income, spending habits, and financial goals to offer recommendations tailored to individual needs.

For example, platforms like IBPO’s ANIKA use AI-driven insights to help users explore financial products that align with their unique circumstances. This level of personalisation ensures that users receive advice that is not only relevant but also actionable.

Clarity and Simplicity

Financial planning can often feel overwhelming, especially when faced with complex jargon and endless options. Digital platforms simplify this process by presenting information in a clear and easy-to-understand format. For instance, users can compare loan options, evaluate interest rates, and understand repayment terms all through intuitive interfaces.

Alignment with Younger, Tech-Savvy Malaysians

Malaysia’s younger generation is driving the adoption of digital financial consultants. Millennials and Gen Z, who make up a significant portion of the population, are highly comfortable with technology and value efficiency in their financial planning.

Simplifying Loan Comparisons with Digital Platforms

Choosing the right loan can be daunting, especially with so many options available. Interest rates, repayment terms, and other factors can make the process confusing. This is where digital platforms excel.

By using digital tools, you can compare loan options side by side, evaluate the pros and cons, and make decisions that suit your financial situation. Many platforms even use technology to provide personalised recommendations, saving you time and effort while ensuring you get the best deal for your circumstances.

This transparency and ease of comparison are helping Malaysians make smarter financial choices. Instead of feeling lost in a sea of options, you can approach your decisions with confidence, knowing you have all the information you need.

Meet ANIKA: IBPO’s Digital Financial Assistant

IBPO is leading the way in digital financial consulting by offering innovative solutions that make financial advice more accessible and engaging. One of its standout offerings is ANIKA, a platform designed to simplify the financial consultation experience.

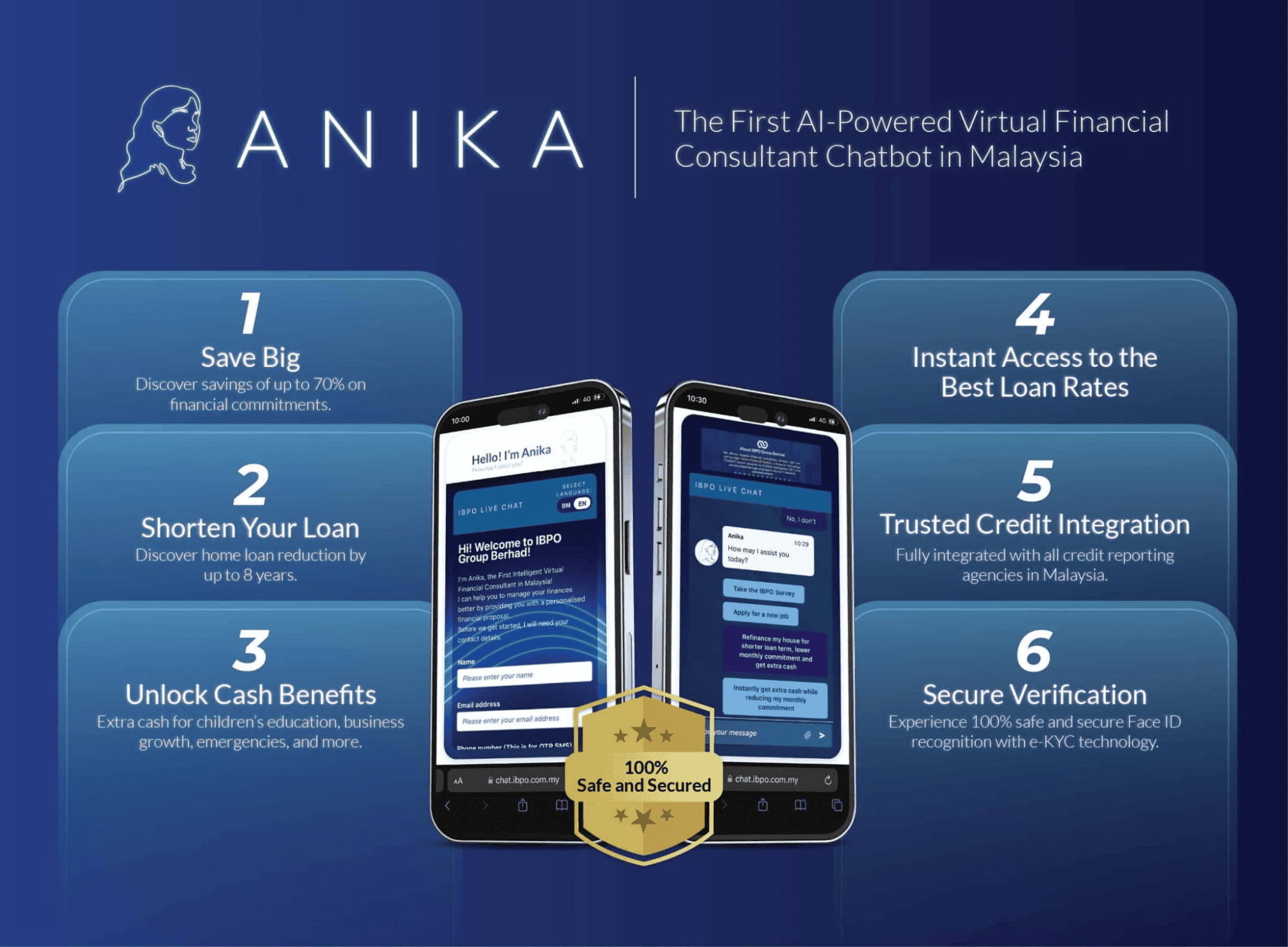

ANIKA (Chatbot)

ANIKA is a virtual financial assistant providing instant access to guidance around the clock. It helps you navigate IBPO’s services, explore financial products, and receive tailored support from our consultants. The platform is designed for ease of use, empowering you to make confident, informed financial decisions.

ANIKA Kiosk

For those who prefer face-to-face interaction, the ANIKA Kiosk is available at IBPO Coffee, our lifestyle-focused café concept. While enjoying your favourite food and beverages, you can receive a free financial health check through the kiosk. It provides instant insights and personalised recommendations, offering a unique blend of digital efficiency in a comfortable, in-person setting.

Extending the ANIKA experience beyond digital platforms, ANIKA Kiosk is available in a self-service format at IBPO Coffee, Malaysia’s first fusion financial café. Visitors can access a free financial health check with instant insights and personalised recommendations. As an on-site alternative to the app, ANIKA Kiosk makes financial guidance easily accessible in a casual, café environment.

What the Future Holds for Financial Consulting in Malaysia

The future of financial consulting in Malaysia is undoubtedly digital. As more consumers turn to online platforms for their financial needs, the demand for accessible, user-friendly solutions will continue to grow.

Companies like IBPO are well-positioned to lead this transformation, offering cutting-edge tools like ANIKA and the ANIKA Kiosk to empower Malaysians in their financial journeys. By combining technology with a commitment to transparency and client success, IBPO is redefining financial consulting in Malaysia.

Ready to embrace the future of financial consulting? Contact us today and let IBPO help you secure a stronger financial future. If you’d like to learn more about the ANIKA Kiosk and how it can help you, visit IBPO Coffee’s ANIKA Kiosk page.